Guide to Moving Insurance – Get the Best Coverage for Your Move

How to Book a Mover

Rewarding someone for a job well done is customary, and moving men are no exception. As a customer, you put a lot of faith in moving men, which is why the best ones are rewarded.

Tipping Your Movers

Besides getting reviews and recommendations from friends and family members, consumers need to check if the company they want to hire is licensed. All legit companies must be registered with the state and provide basic liability protection to their customers.

Licensed Moving Companies

If you plan to hire a moving company, remember that some companies will not move live plants. This is mainly because of the limitations and rules. We've prepared some tips on how to prepare your plants for transportation.

How To Prepare and Move Plants

Moving is fun yet possibly annoying. Making sure your household belongings are safe and sound during your move is essential. Accidents do, however, occasionally occur. It's a smart option to have coverage in these circumstances.

Why Moving Insurance is Necessary

Politeness and manners are required while requesting moving help from friends. Consider these recommended practices when determining whether to ask your friends or family to help you relocate.

Asking Friends for Moving Help

Not everyone finds recycling cardboard easy. Actually, recycling can be a really perplexing task. Sure, some people have special recycling bins where they may dispose of their cardboard. Still, others do not have this luxury, let alone guidelines from local authorities on recycling properly.

How to Recycle Cardboard Moving Boxes

You've decided to move yourself, which involves packing and supplying the strength to move your belongings from your old home to the new one. Should you rent a moving truck or a moving container? Which one offers the best value and is most practical?

Which is Better: Moving Trucks or Moving Containers

Most animals prefer consistency and familiarity, and relocation might cause a lot of uncertainty. The good news is that they typically adjust quickly. Prepare your pets for the journey by following these tips.

Tips for Moving With Pets

Several simple techniques can ease the load of moving on the environment. Here are some suggestions for relocating in a sustainable and green way.

Tips for an Eco-Friendly Move

Businesses are constantly seeking ways to save on operating costs while maximizing storage space for essential products and equipment. A commercial storage facility can be the solution.

Business Storage Tips

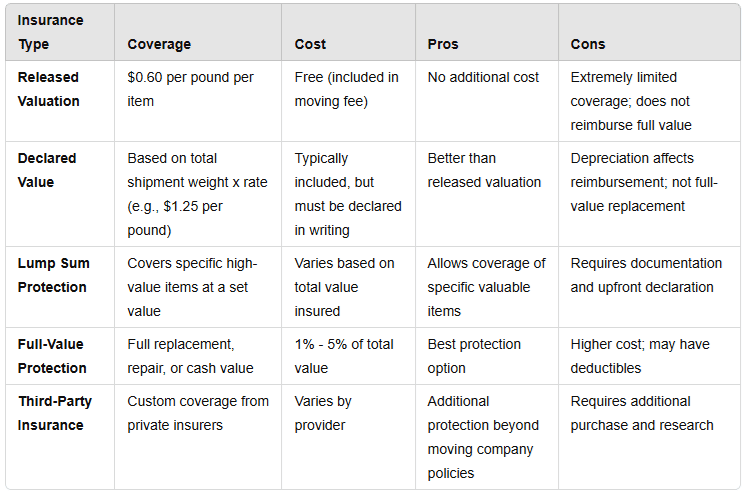

Find out what types of movers’ insurance are available, how much it costs, and if you need it for your upcoming move. Learn what to look for and what questions to ask when shopping for movers insurance.

Do I Need Movers Insurance?

Learn what items are prohibited from storage units and why following the rules is important. Discover the legal, safety and security reasons for not storing certain items in a storage unit.

What Items Should Not Be Stored in a Storage Unit

How Protect Your Belongings and Property

Despite everyone's best efforts, accidents can and do happen. Damage to your property can occur when it is being carried in or out of the moving truck and during transit. Moving insurance is an important part of your move, and you must choose the right coverage to cover the value of your household goods.

The Federal Motor Carrier Safety Administration (FMCSA), part of the Department of Transportation (DOT), regulates interstate moving companies and requires them to provide liability coverage. Local movers, however, follow state laws, which vary by location. Some states require moving companies to carry specific liability insurance, while others have different rules. Check your state's regulations on moving insurance. You can verify a mover’s compliance through the FMCSA’s "Protect Your Move" database or contact your state’s transportation authority.

Most homeowner's and renter's insurance policies do not cover the cost of items that are damaged or lost during the relocation. Moving insurance may be worth looking into because moving exposes your possessions to many potential issues.

What Is Moving Insurance?

You'll need sufficient coverage for your household belongings before a mover arrives to bundle your possessions for your forthcoming move. Moving insurance covers your possessions while moving to your new home. When your items are on the truck and occasionally when they are in a temporary storage facility, they are protected. Get moving insurance to safeguard your items during transit for your peace of mind.

You can inquire about moving insurance from the professional mover you hire. These insurance plans will pay for any goods that are misplaced, broken, or stolen while you are moving.

However, the coverage provided by local moving companies is different. Many people think that a moving company provides full insurance to cover losses and damages. The truth is a little more complicated. Many moving companies provide some protection to their clients in the form of a mover's valuation.

Do You Need a Moving Insurance

The value of your possessions and the distance you are traveling determine whether you should consider purchasing moving insurance coverage. You might feel more at ease if you have moving insurance. Conversely, you might not feel as worried if you're walking down the street.

Moving is a major event that requires careful planning, and one important factor to consider is moving insurance. No one wants their belongings to get lost or damaged during the move, and without insurance, you could face financial losses. Many moving companies offer basic coverage, but it usually only covers a few cents per pound, which may not be enough to replace valuable items. This type of coverage, called "released value protection," is cheaper but provides minimal protection. For full coverage, you may need additional insurance. Check with your home insurance provider to see if they offer any coverage for moving-related losses.

Understanding the conditions of the moving insurance policy is important, especially the bill of lading, which serves as the formal agreement between you and the mover. This document itemizes all your belongings, and it is crucial to ensure that everything is accounted for and that you understand the terms of the agreement. The bill of lading also outlines the coverage limits so you understand the extent of the coverage you are getting. You can buy an additional insurance plan from an outside vendor if you are dissatisfied with the coverage provided by your mover. No matter what level of protection you select, reading the insurance terms and the bill of lading will allow you to make an informed decision and offer you peace of mind knowing that your goods are covered.

Special Considerations for Specific Groups

Moving insurance matters for everyone, but some groups have unique risks and needs when relocating. Choosing insurance based on your situation can help you feel more secure.

For Seniors

Seniors often move to live closer to family, move into assisted living, or downsize. These moves often involve fragile items like antiques or medical equipment that basic insurance might not fully cover. Seniors should consider full-value protection or insurance that covers careful handling of fragile items. Hiring movers who have experience with senior relocations can reduce stress and lower the chance of damage.

For Military Families

Military families move more often than most people, usually on short notice and with government-assigned movers. The Defense Personal Property Program (DP3) includes basic coverage, but it may not protect valuable or personal items well enough. Extra insurance from outside providers can fill that gap. Since military moves often involve several handlers, it helps to take photos and keep receipts for your belongings.

For Students

Students may not move much furniture, but they often have expensive electronics like laptops and gaming consoles. Basic insurance may not fully protect these electronics. Renters’ insurance might cover them during the move, or a parent’s homeowner’s policy could apply. Check this before you move to avoid surprises. If you're using a budget or DIY mover, make sure they include some kind of liability coverage.

Do Movers Provide Moving Insurance?

Yes, most movers offer moving insurance, but the terms and coverage vary by company. Some include basic liability protection in their standard services. While some companies offer limited liability coverage, which provides minimal protection, others offer full-value protection, which covers the replacement costs of damaged items. It's important to carefully read the contract and insurance options to ensure enough coverage for your belongings. Standard policies may not cover damage from natural disasters.

How Much Coverage Do You Need

Start by inventorying your goods to decide your required insurance. You'll have a better idea of the value of the things you wish to insure after doing that. You must also determine if you want to insure all of your belongings or just a select few. Depending on the type and extent of coverage, as well as the provider, the cost of covering your possessions during your relocation might vary dramatically.

Released Valuation

Most licensed movers automatically provide released valuation, not insurance. Released Valuation coverage, or the basic liability insurance as it is commonly called, is usually available as part of your standard moving fees at no extra cost, but you have to sign for it. Under this plan, the moving companies assume liability for your items up to a value of $0.60 per pound per article. So if an object weighs 100 pounds, the mover's liability is $60 on that item, regardless of the actual value of the item. Basic liability insurance will not provide full coverage for damaged goods.

Damage caused by poor handling isn’t always covered under basic moving coverage. If a mover drops a couch or breaks a television because of careless handling, Released Value Protection still limits the payout to 60 cents per pound. The amount you’re paid doesn’t increase even if the mover is at fault. Many people are surprised to learn that negligence doesn’t lead to full reimbursement.

This valuation choice does not completely protect your belongings. Based on their estimated worth, household goods won't be replaced or repaired by your moving company. Instead, they will only pay you according to the weight of each item.

Declared Value

The value of your possessions is based on the total weight of the shipment multiplied by a specific amount per pound (minimum charge of $1.25 times the weight). You decide the dollar amount. For example: if the specific amount is $1.25 per pound, and your household goods weigh 5000 pounds, the moving company would be liable for a maximum of $6,250. In the case of damage, the insurance will be based on the depreciated value of the damaged item up to the maximum value of all the items you shipped. The depreciated value of the item limits the amount of protection.

Homeowners insurance may cover moving-related damages, but it usually applies only if you hire a professional moving company and notify the insurer ahead of time. It often excludes self-moves and may only apply while your belongings are in transit, not during loading or unloading.

Lump Sum Value Protection

Lump-sum value insurance allows you to insure your items based on their actual value, usually per $1,000 of value, and not by their weight. You decide the item's value, and the mover is liable for that value. To choose this option, you must make a declaration in writing on the moving contract.

Full-value Protection

This coverage will cover all damaged or lost articles by replacing, repairing or providing a total cash value for the item. Usually, there is a minimum coverage amount of applicable deductibles. This is the most expensive option and must be purchased in advance. This is a good option for high-value items.

In addition to all the options listed above, extra insurance can be purchased through an independent insurance company that will cover you for the duration of the move. Your mover should be able to assist you with an insurance company that will insure your move.

Some homeowner or renter insurance policies cover approximately 10 percent of the value of your personal property, including coverage for breakage and theft in transit, minus the deductible. Check with your insurance provider if your household goods are covered during the move.

Third-Party Insurance

If the dangers and exposures to your possessions have grown, you can enhance your coverage. Consider a separate responsibility if the valuation insurance is insufficiently protective. This coverage will further protect your items. To locate the best policy that suits your requirements and price range, get in touch with a number of insurance companies and evaluate their rates and coverage possibilities.

Separate liability is a third-party freight liability insurance that is optional and subject to state regulation. This insurance is available from the moving firm. The basic carrier liability amount that movers must pay is deducted from the insurance amount that is covered by the policy.

After you purchase the insurance coverage, the moving company is required by federal law to give you a copy of it. They have to follow this legal requirement. The moving business is responsible for all claims, losses, and damages attributable to their negligence if they violate the law.

Reputable Insurance Providers:

1. Baker International: Specializing in moving insurance, Baker International offers comprehensive coverage options tailored to your needs. They provide both full-value protection and limited liability coverage, ensuring your possessions are well-protected during the move.

2. MovingInsurance.com: This company offers various moving insurance plans, including full replacement and total loss coverage. They also offer additional protection for high-value items, making them a versatile choice for many moving scenarios.

What If You're Using Multiple Moving Companies?

If your move involves more than one company, like one for pickup and another for delivery, figuring out the insurance can get complicated. Usually, the company that has your belongings when damage or loss happens is responsible. You should arrange insurance ahead of time and make sure all the companies are on the same page.

To avoid confusion, find out which company is responsible for insurance during each part of the move. If you're using third-party insurance, make sure the policy covers the whole move, including when one company hands off your items to another. Keep track of which mover has your items at every step, and ask for a written agreement that explains who’s responsible.

Cost of Moving Insurance

Understanding the cost of moving insurance is important for making an informed decision. Several factors affect the price, and knowing them can help you choose the right coverage. Here’s a breakdown of the key cost factors for different types of moving insurance:

Basic vs. Full-Value Protection

• Basic Coverage (Released Value Protection):

• Cost: Free (included in the moving fee).

• Coverage: Provides minimal protection at 60 cents per pound per item.

• Example: If a 100-pound dining table is damaged, you receive $60, regardless of its actual value

• Ideal For: Low-value items or short-distance moves where the risk of damage is low

• Full-Value Protection:

• Cost: Typically 1% to 2% of the total value of your belongings.

• Coverage: Covers the full repair, replacement, or cash value of any damaged or lost item.

• Example: If your belongings are valued at $50,000, you may pay between $500 and $1,000 for full-value protection.

• Ideal For: High-value items or long-distance moves where the risk is higher.

Detailed Breakdown of Cost Factors

1. Type of Coverage:

• Basic Coverage: Included at no extra cost, but offers minimal protection

• Full-Value Protection: Costs more but provides comprehensive coverage

2. Value of Belongings:

• Higher Value: Increases the cost of full-value protection

• Example: For belongings worth $100,000, full-value protection may cost between $1,000 and $2,000

3. Distance of Move:

• Long-Distance Moves: Typically incur higher insurance costs due to increased risk

• Short-Distance Moves: Lower risk and potentially lower insurance costs

4. Deductibles:

• Higher Deductibles: Can reduce the premium but increase out-of-pocket expenses in case of a claim

• Example: Choosing a $500 deductible over a $100 deductible can lower your insurance premium

5. Additional Coverage Options:

• Natural Disasters: Coverage for damage from floods, earthquakes, etc., can increase costs

• Temporary Storage: If your belongings are stored temporarily, additional insurance may be needed, raising the overall cost

Potential Costs for Different Insurance Types

1. Basic Coverage:

• Cost: Included in moving fee

• Example: No additional cost, but limited to 60 cents per pound per item

2. Full-Value Protection:

• Cost: 1% to 2% of total item value

• Example: For $50,000 worth of belongings, expect to pay between $500 and $1,000

3. Third-Party Insurance:

• Cost: Varies based on coverage options and provider

• Example: Additional $200 to $1,000 depending on the extent of coverage and value of items.

FMCSA complaint data shows that Florida, California, and Texas have some of the highest numbers of moving-related claims because of their large populations and frequent relocations. This might affect your choice to buy full-value or third-party coverage.

Cost-Saving Strategies for Moving Insurance

If you want to save money on moving insurance, try these cost-cutting strategies:

• Bundle Policies: Some insurers let you bundle moving insurance with homeowners' or renters' insurance, lowering overall costs.

• Increase Deductibles: A higher deductible lowers monthly premiums but increases out-of-pocket costs if you file a claim.

• Self-Insure for Low-Risk Moves: Consider setting aside funds for potential losses instead of buying a policy for local or short-distance moves.

• Use Credit Card Protection: Some credit cards offer purchase protection that may cover moving-related damages.

Does Homeowners Insurance Cover Items While moving?

It is subject to the particular provisions of the homeowner's insurance policy. While being moved, personal property may be covered in some homeowner's insurance plans to a limited extent, while in others, it may not be covered at all.

Typically, homeowner's insurance policies cover personal property while it is present at the insured's primary house. However, the amount of protection provided for personal effects while they are moving may be restricted or excluded.

It's important to carefully read the terms and conditions of your homeowner's insurance policy to understand what is covered and what is excluded, including coverage for items in transit during a move.

Insurance Options for DIY Truck Moves

If you're handling the entire move yourself, including renting, loading, and driving the truck, you’ll need insurance options that cover more than basic moving protection. Here are some important insurance options to consider when moving yourself:

1. Rental Truck Coverage

Most rental truck companies offer optional insurance plans. These often include:

• Damage Waiver: Covers damage to the rental truck.

• Cargo Protection: Covers your belongings while they’re in the truck. Some plans limit coverage based on item value or type.

• Supplemental Liability Insurance: Extends liability coverage beyond your personal auto policy.

• Personal Accident and Medical Coverage: Covers injuries to you and your passengers during the move.

Read the rental company’s policy details carefully. Some plans may not cover damage from poor packing or natural disasters.

Truck rental companies like U-Haul and Penske usually provide physical damage waivers for the truck, but they don’t automatically cover your cargo. Even if you buy their “SafeMove” plan or a similar one, it might not cover damage to your belongings caused by sudden braking, poor securing, or movement during the drive.

2. Credit Card Coverage

Some credit cards include rental vehicle insurance, although this coverage may not apply to large moving trucks.

3. Personal Auto Insurance

Most auto policies don’t cover rented moving trucks, especially large ones. Ask your insurance company if your policy includes any coverage.

4. Third-Party Moving Insurance

If you're worried about your belongings during the move, consider buying third-party moving insurance. These plans often provide better protection than what's included with truck rentals and may cover theft, damage, and other risks.

International Moves

Moving insurance becomes even more important when moving internationally. Longer distances, different forms of transportation, and perhaps different legislation and customs procedures are all factors in international relocation. Comprehensive moving insurance can protect your things during the complicated international moving process.

Deductibles and Coverage Limits

It is important to understand the potential deductibles and coverage limits mentioned in your policy. A deductible is the amount you must pay out of pocket before your insurance coverage kicks in. Understanding your deductible allows you to plan and budget accordingly in the event that you need to file a claim.

Coverage limits represent the most your insurance provider will pay for a claim. You need to get familiar with these restrictions in order to ensure that you have appropriate coverage for your important possessions. Understanding the coverage limitations allows you to determine whether you must purchase more coverage or make other arrangements to protect assets exceeding those limits.

Estimating the Value of Your Possessions

Accurately estimating the value of your household items helps you choose the right moving insurance. Use these simple steps to figure out how much your belongings are worth.

• Create an Inventory List: List all the items in your home. Go room by room to ensure you don’t miss anything. This list will serve as a comprehensive record of your possessions.

• Research Replacement Costs: Look up current prices for similar items. Check online stores or catalogs for electronics, furniture, and appliances to understand the replacement cost. Keep receipts if you have them.

• Use Valuation Guides: For items like jewelry, antiques, and collectibles, use valuation guides or consult with professional appraisers. These items often appreciate in value, and accurate appraisals ensure you have the right coverage.

• Consider Depreciation: Understand that some items lose value over time. Calculate the depreciated value of items, especially for older electronics and furniture. This helps in getting a realistic valuation for insurance purposes.

• Photograph and Document: Take photos of valuable items and keep them with your inventory list. This visual documentation is important if you need to file a claim.

• Estimate Total Value: Once you have individual values, sum them up to get the total value of your possessions. This total will guide you in choosing the appropriate level of insurance coverage.

How Do I Prove the Value of Handmade or Sentimental Items?

Proving the value of handmade or sentimental items, such as custom furniture, collectibles, or family keepsakes, can be difficult because they often don’t come with receipts or clear market comparisons. For handmade pieces, have them appraised by a certified professional and keep the appraisal report as documentation.

Record how the item was made, materials used, and any awards or recognition it received. Emotional value can’t be insured, but you can still assign a fair market value using similar online listings or past appraisals.

Photos, the creator’s name, and written descriptions can also support your claim if you need to file one. List these items in your inventory and check if your insurance covers them.

Common Exclusions in Moving Insurance

Understanding what isn’t covered by moving insurance can save you from unexpected surprises. Most moving insurance policies come with a list of common exclusions that might affect your coverage. Knowing these can help you plan better and avoid potential pitfalls.

1. High-Value Items

Many standard moving insurance policies exclude high-value items like jewelry, artwork, and collectibles. These items often require additional coverage due to their high value and risk of damage.

2. Damage from Natural Disasters

Damage caused by natural disasters such as floods, earthquakes, and hurricanes is typically not covered under standard moving insurance policies. Special insurance might be necessary to cover these risks.

3. Owner-Packed Items

Items packed by the owner are often excluded from full coverage. Insurance companies usually cover only professionally packed items, as improper packing can lead to damage.

4. Perishables and Plants

Perishables and plants are usually excluded from moving insurance coverage due to their fragile nature and the difficulty in ensuring their safety during transit.

5. Items Left in Storage

If your belongings are stored temporarily during a move, they might not be covered unless you have specific storage insurance. Standard policies often exclude items that are not in transit.<>

6. Insurance Gaps Exist When Items Are in Temporary Storage

Many moving insurance policies, including full-value coverage, don’t automatically cover items kept in temporary or long-term storage unless you buy separate storage insurance. If your belongings will be stored for a few days between moves, make sure your policy includes coverage during that time.

7. Certain Types of Damage

Wear and tear, gradual deterioration, and damage due to temperature changes are often excluded. Moving insurance typically covers sudden and accidental damage, not ongoing issues.

8. Specific Fragile Items

Items like glassware, mirrors, and electronics might have limited coverage unless packed professionally. These items are prone to breakage and often require special handling.

9. If a natural disaster, such as a flood, damages your furniture, basic or full-value protection usually won’t cover it unless you buy additional disaster coverage.

Federal Law

The Federal Motor Carrier Safety Administration (FMCSA) mandates that all interstate moving companies offer two levels of insurance coverage: released value protection and full value protection. Keep in mind that released value coverage only offers a small amount of coverage per pound, whereas full value protection covers the entire value of your belongings. It is advised to carefully research a moving company's policies on insurance before hiring them, as well as to confirm that they have a license and are registered with the FMCSA's "Protect Your Move" program.

Time-Sensitive Claims

It is essential to file an insurance claim immediately after suffering a loss or injury. Many customers are unaware that there is often a time limit for filing claims following a relocation. Prepare yourself with the exact dates and conditions of your moving insurance policy to guarantee you can file a claim if needed. Read your policy, note the deadlines, and acquire the essential papers beforehand.

You must follow a strict federal deadline to file a claim. Federal rules require you to file a claim for loss or damage within 9 months of delivery. This deadline comes from regulation 49 CFR § 370.3. If you miss this deadline, you lose the right to recover damages, even if the mover is at fault.

Notify your insurance provider as soon as possible so that the claims process can begin promptly. You may ensure a smoother claims process in the event of loss or damage during your relocation by understanding time limits, meeting regulations, and maintaining open communication with your insurer.

After you file a claim, the response time depends on the insurer, how complex the case is, and whether your paperwork is complete. Most responses arrive within 30 days. Claims with missing paperwork or large losses may take 60 to 90 days.

You can speed things up by sending clear photos, receipts, inventories, and signed delivery reports. Follow up with the insurer if they don’t confirm receipt within a week. Ask them how long the process usually takes and what steps come next.

Extra Tips

When meeting with the potential moving company, make sure to ask the representative about their insurance options. Know the total number of items you are moving. Write down all valuable pieces of furniture, glassware, appliances, electronics, etc., while considering the total weight of what you are moving and the replacement value of each item. Take photos of all high-value items. This will help to track your inventory and will help if you need to make a claim.

Your mover's responsibility may be restricted in some situations, which makes purchasing moving insurance more appealing.

In the event of damage or loss, images and documentation can be helpful, much like with your homeowner's insurance. Create a moving inventory to keep track of your possessions and take before-move photos of objects to show their condition.

Always keep valuable and essential items close to you. This could include money, pricey jewelry, laptops, documents, and artifacts from the family. In fact, certain service providers might forbid moving priceless objects, so check your contract.

Common Moving Insurance Scams

Unfortunately, some fraudulent movers and fake insurance providers try to scam customers. Here are common moving insurance scams and how to avoid them:

1. Fake Insurance Policies: Some dishonest movers claim to offer full insurance but provide no actual policy.

• How to Avoid: Always ask for proof of insurance and verify the mover’s license with FMCSA (for interstate moves) or state agencies (for local moves).

2. Misleading "Full Coverage" Claims: Some movers advertise "full coverage" but only offer a released valuation ($0.60 per pound).

• How to Avoid: Read the bill of lading carefully and ask for written confirmation of coverage details.

3. Claims Denial Tactics: Fraudulent movers may ignore or refuse claims, blaming the customer for damages.

• How to Avoid: Take before-and-after photos of valuable items, document damages immediately, and file complaints with FMCSA or state authorities if necessary.

Challenges and Solutions in Moving Insurance

Lack of Clarity on Coverage Types: Many people are unaware of the different types of moving insurance available, leading to inadequate coverage.

Solution: Conduct thorough research and consult with insurance experts to understand the best type of coverage for your specific moving needs.

Overlooking International Regulations: When moving internationally, people often neglect to consider the different laws and regulations that apply to insurance in the destination country.

Solution: Consult with international moving experts and legal advisors to ensure your insurance coverage is compliant with international laws.

Ignoring Seasonal Risks: People often forget that moving during certain seasons, like winter, can pose additional risks to their belongings.

Solution: Opt for a comprehensive insurance plan that covers seasonal risks such as water damage from snow or mold from humidity.

Underestimating High-Value Items: High-value items like artwork or antiques are often underestimated, leading to insufficient coverage.

Solution: Get your high-value items professionally appraised and ensure they are adequately covered in your moving insurance policy.

Not Considering Storage Risks: If your move requires temporary storage, there's an additional risk of theft or damage during that period.

Solution: Make sure your moving insurance covers the period your belongings are in storage, or purchase additional storage insurance.

Unique Insights and Practical Tips

Document Everything: Keep a detailed inventory and take photos of all items before the move. This will be invaluable in case of loss or damage.

Check Your Home Insurance: Some home insurance policies offer partial coverage for moving. Double-check your policy to see if you can save money.

Negotiate: Don't settle for the first insurance quote you get. Negotiate with multiple providers to get the best deal.

Read the Fine Print: Always read the terms and conditions carefully. Look for any exclusions or limitations that could affect your coverage.

Find Movers in Your State

About the Author:

Margarita Hakobyan is the founder and CEO of MoversCorp.com. She has published more than 300 articles about moving, storage, and home organizing, making her a moving specialist since she began writing about the moving industry in 2005.Copyright © 2008-2025 Local Movers Corp All rights reserved 1-888-755-2212